How to Price Your Home Right

TABLE OF CONTENTS (skip ahead)

TABLE OF CONTENTS (expand)

by Homepie | Published Jan 21, 2021

When it comes to sales in general, few things matter more than the numbers. But determining price isn’t always easy. This is especially true when it comes to selling homes and setting the right asking price. Because we naturally become emotionally attached to our homes, we can combine market value with sentimental value. But if you are serious about selling your home – especially if you are selling without an agent – it’s critical to know how to fairly and competitively price your home.

Ask for too little and you lose equity. Ask for too much and you may not have any offers.

Even in a seller’s market, overpricing your home too much can be a total buzzkill. The longer it sits on the market without any offers, the more likely buyers will think something is wrong with it. It becomes a stale listing. And there are plenty of buyers who love making lowball offers for such properties.

There are many factors that influence the home pricing process.

Ideally, the goal is to get the maximum value within a reasonable amount of time.

Follow these basic steps in this article and you’ll arrive at the right figure to meet that goal.

Check the Estimated Value

The best starting point is to check the estimated value. There are many valuation tools available online to assist you to find the fair market value of your house. The fair market value is the price that your house would sell for under normal market conditions.

When you browse homes on popular real estate sites, you’ll come across pricing estimates. Zillow, for example, brand theirs as a “Zestimate.” What you’re actually seeing is an automated valuation model or AVM. For those of you with a zest for tech, this refers to “a service that uses mathematical or statistical modeling combined with databases of existing properties and transactions to calculate real estate values.” [1]

All you need to do is search for your property address and write down the estimated value. You can also compare the results from a few different websites.

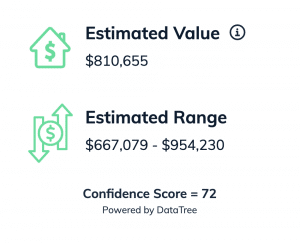

Tip: The great thing about homepie.com is that when you start the free listing process, you will be provided with an estimated value, a price range, and a confidence score. The latter is especially helpful in determining the accuracy of the provided data.

Again, this is just a ballpark figure to give you a general idea. Anything automated is rarely ever precise. Currently, AVMs can’t factor in the condition of a home or upgrades. But they’re slowly improving with time.

Make a List of Recent Home Sales

Now it’s time to make a list of “comps” or comparable sales. These are similar homes in your neighborhood that have recently sold.

There was a time when only real estate agents had access to homes sales records. Now all that information is readily available online. It’s just like shopping for a home. The difference is that you’ll want to locate your neighborhood in the map and make sure the search filter is set to “sold.”

Buyers will be looking at these comps when deciding how much they should offer. Ideally, you’ll want to find homes that have sold in the last couple months because they reflect the current market. If none are available, you’ll need to include comps that are older (up to 12 months).

As you research and create a list of comps, make sure you’re always comparing apples to apples. This especially relevant when it comes to size and the year built.

When it comes to square feet, comps are typically within 15-20% of the subject property and have similar bedroom, bath, and lot size. Track homes are usually easy to evaluate due to their cookie-cutter construction and lot sizes.

It’s best to compare homes with a similar age (within 10 years apart). A house built in 1950’s isn’t on par with one built in the 80’s. Not that you can’t use them if you absolutely have to, but it get’s more challenging.

When you make your list of comps, make sure to include the address, pricing, date sold, and the square footage of each home.

Calculate the Square Footage

The size of your home plays an essential role in your listing price. When it comes to the fair market value, there is usually a median price for each square foot. Of course, this is only a baseline and this price is influenced by factors such as location.

To get a more accurate value, determine the price per square foot by using your list of home sales. For each home, simply take the purchase price and divide it by the square footage. It should be noted that typically, the price per square foot is slightly higher for smaller houses and lower for larger homes. You can then take this price per square foot and multiply it by your home’s square footage to get an idea of the fair market value.

This might seem unnecessary, but it’s actually one of the most important steps in determining an accurate price.

According to Sean Crosier, a California real estate broker for over 16 years, “The average seller isn’t aware that square footage of living space is the most impactful factor in determining a home’s value.”

To illustrate, let’s say your home is 1,600 square feet. A similar home on the same street recently sold for $650,000 that has 2,000 square feet. You might feel tempted to list your home in the same price range. After all, it’s only 400 square feet more right? Well, the price per square foot of that home is $325 ($650,000/2,000). If you take that 400 and multiply it by $325, we’re actually talking about a $130,000 difference! That means – all things being equal – the value of your home looks more like $520,000.

Factor in Renovations

Now that we have a very close figure, we can fine tune by factoring in what upgrades might justify a higher asking price. We’re not talking about new paint or stain-free carpet. There is basic home maintenance and there are upgrades.

Keep in mind that not all renovations boost the value of your home. Kitchen and bathroom remodels typically make the biggest impact when it comes to added value.

New flooring can also make a difference. Just make sure that whatever improvements you make, do them right. Don’t be tempted to cut corners.

When it comes to exterior upgrades, upgrades like new roofing, new windows (especially dual pane), an added pool, or a new garage door can increase the overall value of your house.

So how much more can you add to your asking price for making such improvements? Realistically, it’s not going to be the same amount that you invested. So let’s say you just remodeled your kitchen and paid $15,000. You could probably tack on another $10k. That’s why it usually makes sense to enjoy the upgrades you make for at least a couple years before you sell.

Be Flexible

If you plan on selling your home within a reasonable period of time, you’ll need to be flexible when it comes to your asking price. This will become apparent especially if you present and promote your home right, yet receive little to no attention from buyers. Even after doing your homework to find an accurate price, you still may have to make adjustments.

“Ultimately the market decides what your home is worth, ” says Crosier.

“If you prepare your home the right way, get professional photos, expose it to the mass market via MLS and syndication, and you get no showings or offers in the first 2-3 weeks, its time to reduce your price. Be smart and listen to the market.”

Now if you’re selling a ranch out in the boonies or a multimillion dollar luxury property then there’s a different set of rules. But for most average homes in a populated area, it’s a good rule of thumb.

It’s also wise to be cognizant of the pricing parameters that people search. Even if your home is worth $505,000, reducing it by $5,000 would probably make it appear in more results, especially for those searching below the $500k price point.

Listing your house at one price is not a one and done thing. Many factors may come up that were not previously anticipated that may spark the need for necessary changes.

Get Expert Advice

If you’re still having trouble pricing your home or just need that added boost of confidence, you could always hire an appraiser. But be prepared to spend $600-1,000 for that professional opinion. For most sellers, this is an unnecessary expense.

A far more affordable option is to order a Pricing Review for only $99. This will provide you with a detailed report on the current state of the market in your neighborhood. In addition, you’ll learn more about the nuances of pricing your home and gain tips on how to sell your home on your timeline and for the most money. Simply create a free account on homepie.com and select this option when you list your home.

It never hurts to get a second opinion. In fact, because we grow so attached to our homes, it can be quite helpful.

Now you know the basics of how agents price homes. This will allow you to negotiate from an informed position and justify the price tag your home deserves.

––––––––––

[1] Investopedia. “Automated Valuation Model (AVM).” Accessed Jan. 2021.