Home Buying in California:

Is Now a Good Time?

TABLE OF CONTENTS (skip ahead)

TABLE OF CONTENTS (expand)

by Homepie | Published Dec 14, 2020

With interest rates at all-time lows, you may be wondering if it is a good time to buy a home in California. A lot of factors other than interest rates go into this consideration, including the local economy, your financial state, and the housing market. The more you know about the home buying process and current real estate trends, the better you will be able to navigate through the process of home buying in California.

You don’t have to navigate this process alone! Homepie.com helps navigate you through the process without the need for a realtor through our marketplace. Let’s walk through some important factors to consider when deciding on whether now is a good time to buy a home in California.

Interest Rates Are Historically Low

One of the biggest incentives for buying a home is current mortgage interest rates. The lower the rates, the more affordable the loan is. Some even see this savings on interest as an opportunity to buy a bigger home.

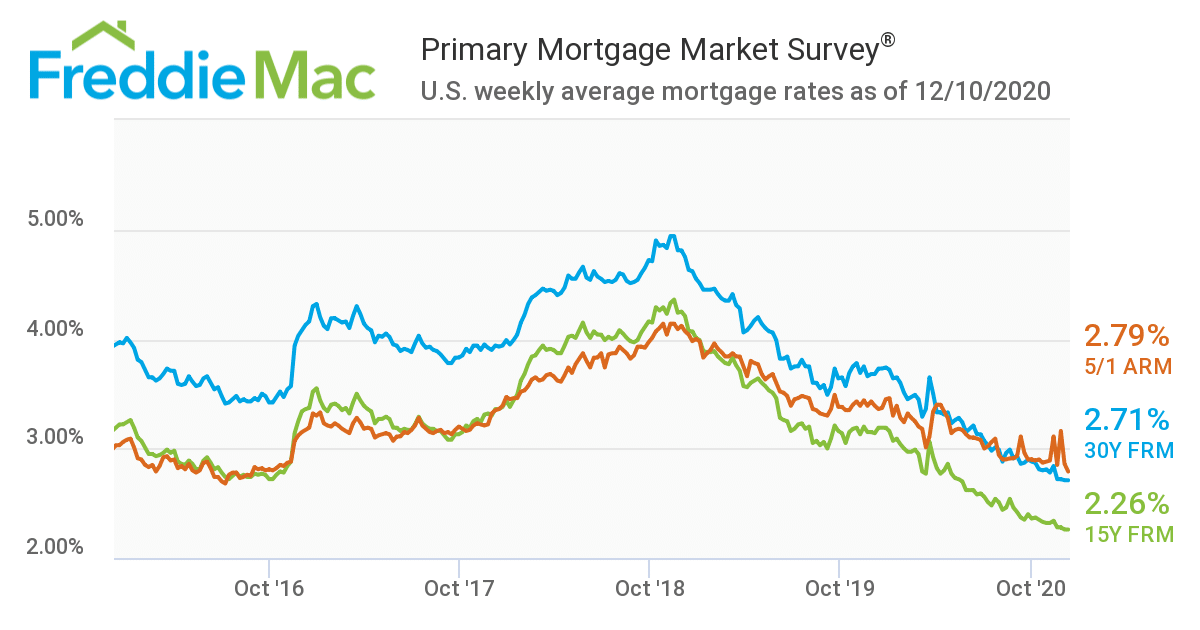

Mortgage interest rates are currently at an all-time low. As of December 10, 2020, the average rate for a conventional 30-year fixed mortgage in California is 2.71%. That makes purchasing a lot more affordable than it was last year.

Granted, the interest rate that you receive will depend on the bank financing your loan, your credit score, and if your loan is for a primary single-family residence.

You can get an even lower interest rate with a shorter loan period. However, your monthly payment will be substantially more than it would be for the traditional fixed 30-year mortgage. There are also different mortgage loan types in addition to the traditional fixed-interest rate type, including adjustable-rate, FHA, VA, and jumbo mortgages.

As of November 25, 2020, the average value of a home in California is $589,659. This number is adjusted seasonally and does not include homes in the low or very high price tiers. So, this value is reflective of what a single-family home would cost for the average person.

The table below details the current fixed interest rates, and estimated monthly payments based on loan term, the average home value, and assuming 20% down. The estimated monthly payment does not take into account yearly property tax or homeowners insurance costs, which are typically calculated by your lender and added into your monthly payment. The money is then kept in an escrow and paid to the appropriate parties by your loan provider.

Your bank will give you an Annual Percentage Rate (APR). This rate is usually higher than the mortgage interest rate because it takes into account the other costs of borrowing money, such as mortgage lender fees, and will more accurately reflect your monthly payment. But it still does not include escrow payments for property taxes and home insurance, which will vary from home to home and depend on location.

Estimate for a $471,727 Mortgage Loan

| Term | Rate | Monthly Payment |

| 30-year | 2.75% | $1,926 |

| 20-year | 2.75% | $2,558 |

| 15-year | 2.25% | $3,090 |

| 10-year | 2.25% | $4,394 |

With the current mortgage interest rates, now is a great time to buy a home. However, you still need to consider your current financial status, job stability, credit score, and the housing market.

Your Financials & Credit Score

Your financial status and job stability are obvious factors in deciding to buy a home. Along with your credit score, they are also the main factors a bank will weigh when deciding on whether to approve financing your loan.

The best way to be prepared is to maintain your credit score and get pre-approved for a mortgage loan. For the lowest interest rate, you will want to maintain a very good FICO credit score of 740 or higher.

Getting pre-approved gives both you and the seller confidence that neither of you are wasting your time and that if you put in an offer and they accept, you’ll be able to quickly get financing and close on the home.

However, if you have been pre-approved and something changes in relation to your finances or credit score, it can void your pre-approval. This is why it essential to ensure that you are financially stable and maintain your credit score by keeping your debt ratio low and paying all of your bills on time.

Since your loan provider will play a big role in the purchasing and closing of a home, it is important to choose a lender that has a good track record and customer service. After all, this is the company you will be dealing with for many years.

The Housing Market and Appreciation

The median price for homes in California is projected to increase by 1.3% in 2021, while interest rates are expected to remain low. Job growth in California is also projected to increase by 0.5%, which is a good sign of economic recovery from the current pandemic.

The number of available homes on the market was 50% lower in 2020 than in 2019 and is expected to remain low for 2021. This, combined with the low supply of new and redeveloped properties, will continue to push home prices up. Mix that with historically low mortgage interest rates, and it may result in bidding wars between those with more margin.

Appreciation is the increase in a home’s value over time-based on fair market values of comparable homes that are for sale in the neighborhood. It also takes into account the overall local real estate market and any improvements that have been made to the home.

Appreciation of homes in California have remained quite favorable over the years. As an example, a home bought in the Van Nuys neighborhood of Los Angeles in 2010 has a current appreciation rate of 98.3%, meaning that the value of homes in this area have doubled over the last 10 years.

Keeping in mind that the appreciation rate will vary from neighborhood to neighborhood, you can see a rate of between 58% and 98% throughout different middle-class neighborhoods in Los Angeles. Appreciation can be expected to remain favorable due to the high demand for housing and low inventory coupled with low mortgage interest rates.

The Takeaway

If you are in a financially stable position, now is a great time to buy a home in California. With all-time low mortgage interest rates, you can buy a bigger house with more space for your family. While homebuying in California can be quite involved, time-consuming, and costly, homepie.com can help you through the process and save you money with our online marketplace that features homes for sale by owners. By skipping the middleman, you can save a lot of money and gain better insight into the home and area since you will be working directly with the homeowners looking to sell.